EVs Surge Ahead in Southeast Asia – and Why Hydrogen Cars Won’t Overtake Them

Electric vehicles (EVs) are experiencing rapid growth globally, and Southeast Asia is finally catching up to this electric revolution. In 2023, nearly one in five cars sold worldwide was electric, with China, Europe, and the US accounting for 95% of EV sales. In these advanced markets, EVs have become a significant share of new car sales – over one-third of new cars in China, about 20% in Europe, and 10% in the United States. Southeast Asia has lagged behind these leaders, but recent developments show momentum building. This article explores the latest EV market trends in Southeast Asia (with comparisons to global leaders) and explains why hydrogen fuel-cell vehicles are unlikely to overtake battery EVs – crucial insights for aspiring EV charging operators in the region. We’ll back this with market data and expert quotes on what the future holds.

EV Growth in Southeast Asia vs. Global Leaders

EV adoption in Southeast Asia remains modest but is accelerating quickly. As of 2024, EVs make up roughly 10% of new passenger car sales in Southeast Asia, which is a huge improvement from just a few years ago [beaconvc.fund]. This still “contrasts sharply with more advanced markets” – for example, EVs are 43% of new sales in China, 22.7% in Europe, and an astounding 88.9% in Norway [beaconvc.fund]. In other words, Southeast Asia has high potential to grow further, even as it currently trails these EV frontrunners.

Key countries in the region are beginning to close the gap:

- Thailand: The region’s EV leader, Thailand saw its EV sales share rise to 13% in 2024 (up from 11% the year prior) [iea.org]. Thailand is becoming an EV manufacturing hub, attracting global players like BYD and Great Wall Motor to set up production [beaconvc.fund]. Government incentives (like subsidies under the “EV 3.5” program) and local manufacturing commitments have bolstered growth [iea.org].

- Indonesia: Southeast Asia’s largest market tripled its EV sales in 2024, giving Indonesia over 7% EV market share that year [iea.org]. This surge came as conventional car sales fell, signaling a real shift. The government spurred adoption by slashing VAT on EVs from 11% to 1% and waiving import taxes for automakers investing in local EV production [iea.orgiea.org]. These policies lured Chinese EV makers (BYD, GAC Aion) and even global OEMs (Stellantis) to the Indonesian market [iea.org].

- Vietnam: Fueled by homegrown automaker VinFast, Vietnam’s EV sales nearly doubled, reaching about 17% share in 2024 [iea.orgiea.org]. VinFast not only dominates locally but is exporting EVs across Asia and even to the U.S., showcasing regional ambition [iea.org]. This success has put Vietnam’s EV penetration on par with mid-tier European markets like Spain or Canada [iea.org].

- Singapore & Malaysia: Smaller in volume, but Singapore is leading in infrastructure per capita, with plans to deploy 60,000 charging points by 2030 (up from about 1,800 in 2022) as part of its Green Plan. Malaysia and others are also launching EV incentives and local assembly plans, though adoption remains in early stages.

Overall, Southeast Asia’s EV sales grew nearly 50% in 2024 [virta.global]. Policy support – such as tax breaks, import duty waivers, and local production incentives – has been “key in emerging markets” like ASEAN [virta.global]. Governments are clearly betting on an electric future. For instance, Indonesia targets 30,000 public charging stations by 2030 and Thailand 12,000 [iea.org], signaling strong commitment to build out charging infrastructure. This creates a favorable landscape for EV charging businesses, as discussed later.

Meanwhile, advanced economies continue to push EV adoption to new heights. China remains the world’s largest EV market (over 8 million EVs sold in 2023) and even phased out national EV subsidies without slowing growth [iea.org]. Europe held steady around a 20% EV share in 2024 despite reduced subsidies [iea.orgiea.org], and certain countries like Norway are near 90% EV sales [iea.org]. The United States crossed 10% EV share in 2024, with 1.6 million EVs sold [iea.orgiea.org], aided by new federal tax credits and dozens of new EV models. These benchmark markets illustrate where Southeast Asia could be headed in the coming years as conditions improve.

Latest EV Trends and Market Developments

Global EV momentum is stronger than ever, which is encouraging for Southeast Asia’s nascent EV sector. In 2023, global EV sales jumped 35% to nearly 14 million units (over 3.5 million more than 2022) [iea.org]. By the end of 2024, cumulative EV sales had exceeded 20% of all new cars, with about 17 million EVs sold that year alone [virta.globalvirta.global]. The total EV fleet on the road swelled to ~58 million vehicles in 2024 [virta.global] – a remarkable growth trajectory. This rise is expected to continue: Q1 2025 already saw 4+ million EVs sold globally, and the IEA projects over 20 million EVs will be sold in 2025 (about one in four cars) [virta.global]. Such growth underscores that the EV transition is in full swing, not just in China/EU/US but spreading worldwide [virta.global].

Several trends are making EVs more attractive and viable, which will benefit late-adopting regions:

- Falling Costs & More Models: EV battery prices have declined and manufacturers are achieving economies of scale. By 2024 there were 785 electric car models available globally, 15% more than the previous year [virta.global]. With more competition and variety (from affordable minis to luxury SUVs), consumers have better choices than ever. EVs are steadily closing the upfront cost gap with gasoline cars in many markets [theguardian.com].

- Improving Range & Charging Speed: Advances in battery tech are addressing range anxiety and charging times. For instance, CATL’s new Shenxing battery can add ~200 km of range with just a 5-minute charge, and even faster charging prototypes are emerging [iea.orgiea.org]. By 2025, automakers like BYD demonstrated platforms delivering 400 km of range in 5 minutes of charging [iea.org]. While ultra-fast chargers (350+ kW) are still being rolled out, these innovations mean EV drivers will spend far less time waiting to recharge, making EVs even more convenient.

- Charging Infrastructure Expansion: Massive investment is flowing into charging networks globally. Europe expanded public fast chargers ~50% in 2024 [iea.org] and now has tens of thousands of high-speed charging points. China leads with over 1.6 million fast chargers deployed [iea.org], and even the US has topped 50,000 fast chargers with support from federal programs [iea.org]. Asia Pacific is the largest EV charging market, holding ~62% of global charging station investment in 2024 [fortunebusinessinsights.comfortunebusinessinsights.com]. All this growth in infrastructure is reducing one of the last barriers to EV adoption – the ease of finding a charge when needed.

Crucially, industry experts remain bullish on the EV outlook. As one analysis noted, “the long-term outlook of the industry remains positive as EV adoption continues to rise steadily, supported by falling battery costs, improving charging infrastructure, and stronger regulatory mandates” [beaconvc.fund]. In short, the pieces are coming together for an electric transport future. This positive global trend provides confidence to Southeast Asian stakeholders – including prospective EV charging operators – that investing in EV ecosystems is a sound bet.

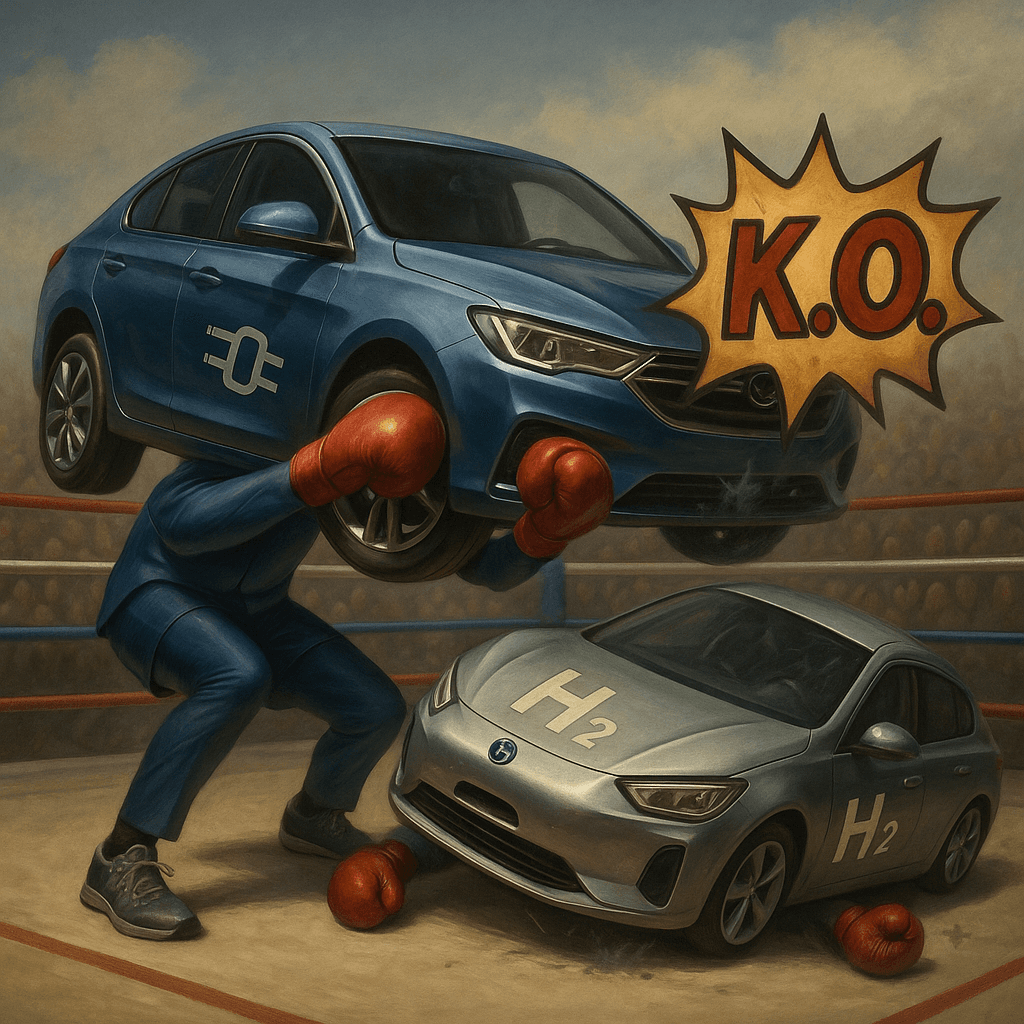

Why Hydrogen Cars Won’t Beat Electric Vehicles

What about hydrogen fuel-cell vehicles (FCEVs) as an alternative? Hydrogen cars have been hyped by some automakers (notably Japan’s Toyota) as the “next big thing.” However, most experts now agree that hydrogen will not overtake battery EVs for passenger cars. The science and market trends make this clear. Michael Liebreich, founder of Bloomberg New Energy Finance, bluntly put hydrogen cars in “the row of doom” – essentially a dead-end niche. Can hydrogen overtake batteries in cars? “The answer is no,” said Liebreich, adding that carmakers betting big on hydrogen are “just wrong” and headed for an expensive disappointment [theguardian.com].

The reasons behind this verdict are multi-fold:

- Energy Efficiency: Hydrogen is an inefficient vehicle fuel compared to using electricity directly. Producing “green hydrogen” (via electrolysis) and then converting it back to electricity in a fuel cell wastes a lot of energy. “If you use green hydrogen it takes about three times more electricity to make the hydrogen to power a car than it does just to charge a battery,” explains Prof. David Cebon of Cambridge University [theguardian.com]. Even with future improvements, fuel-cell cars will always consume significantly more total energy per mile than battery EVs – a fundamental disadvantage noted by many engineers [theguardian.comtheguardian.com].

- Infrastructure & Convenience: EVs can charge anywhere there’s electricity – which is everywhere – but hydrogen cars require a completely new fueling infrastructure with specialized high-pressure stations. This network barely exists and is hugely costly to build. In fact, across all of Europe there are only about 178 hydrogen filling stations (half of them in Germany), versus tens of thousands of EV charging points [theguardian.com]. The UK, for example, has just 9 public hydrogen stations, compared to 31,000 public EV charging locations [theguardian.com]. This chicken-and-egg problem (no stations because no cars, and vice versa) has stymied hydrogen adoption for years. A potential EV charging operator should note: fueling infrastructure is a major hurdle for hydrogen but a growing advantage for battery EVs.

- Market Reality & Adoption: Automakers and consumers have largely voted with their feet in favor of batteries. Batteries are already the post-petrol choice for almost every manufacturer [theguardian.com] – virtually all major car brands either have or plan extensive EV lineups, whereas hydrogen car offerings are limited to a couple of models (Toyota Mirai, Hyundai Nexo). The sales numbers reflect this imbalance: In the UK, fewer than 300 hydrogen cars were sold over 20 years, compared with 1 million electric cars in that time [theguardian.com]. Globally, hydrogen car sales are in mere thousands annually (and even fell by 20% in 2024, signaling waning interest), while EV sales are in the tens of millions [hydrogeninsight.comiea.org]. As Tesla’s Elon Musk quipped, hydrogen fuel cells are “fool cells” – why waste renewable electricity making hydrogen when you can just use that electricity to charge a battery directly? [theguardian.com].

- Cost and Complexity: Hydrogen fuel-cell systems rely on expensive materials (like platinum catalysts) and require high-pressure tanks and cryogenic infrastructure. These factors make hydrogen cars pricey to produce and maintain. Stellantis’s hydrogen vans, for instance, target niche commercial users despite efforts to cut costs [theguardian.com]. Batteries, on the other hand, have enjoyed drastic cost declines and manufacturing learning curves over the past decade. This cost gap isn’t expected to close soon for passenger vehicles. As one report noted, “Compared with that flood of investment [into EV technology], hydrogen is a trickle” [theguardian.com] – meaning the money pouring into improving batteries and charging far outweighs investments in hydrogen cars.

Even proponents of hydrogen now mostly concede that its best use will be in heavy-duty transport or industry, not everyday cars. The International Energy Agency projects hydrogen could account for ~16% of road transport energy in 2050 in a net-zero scenario, but primarily in “bigger vehicles such as buses and lorries” – not in private cars [theguardian.com]. Liebreich agrees batteries will dominate even in trucks, with perhaps a minor role for hydrogen in specific heavy-duty cases [theguardian.com]. And tellingly, Toyota’s own technical chief admitted hydrogen in cars has so far “not been successful,” mainly due to lack of fuel supply [theguardian.com]. All signs point to hydrogen struggling to find a foothold in light vehicles.

For Southeast Asia, which is still building out its alternative fuel ecosystem, the takeaway is clear: battery EVs will be the mainstream solution, and hydrogen cars are unlikely to pose a serious challenge in the consumer market. Countries in the region are thus focusing their strategies on EVs (and sometimes electrified two-wheelers) rather than hydrogen passenger cars. This simplifies decisions for businesses looking to invest in the green mobility space.

Outlook for EV Charging Businesses in Southeast Asia

For prospective EV charging station operators in Southeast Asia, these trends are encouraging. The market conditions are aligning in favor of EVs, creating a burgeoning demand for charging infrastructure:

- Rising EV Adoption = Growing Charging Demand: Every additional EV on the road is a potential customer for charging services. Southeast Asia’s EV fleet, while small today, is set to expand rapidly given the high double-digit growth rates. As more people switch to electric vehicles, “the need for convenient and accessible charging options is becoming increasingly important” [fortunebusinessinsights.com]. Early movers in the charging business can capture prime locations and customer loyalty as this wave builds.

- Government Support for Infrastructure: Regional governments are actively supporting charging rollout, reducing investment risk. Besides Indonesia’s 30,000 and Thailand’s 12,000 charger targets by 2030 [iea.org], countries are offering incentives like grants, tax breaks, and streamlined permits for charging installations. Singapore, for example, is offering subsidies for building chargers in private residences and public carparks, while Thailand and Indonesia include charging infrastructure development as part of their EV policies. Such support can lower costs for new charge point operators.

- Business Models and Revenue Streams: An EV charging operation in Southeast Asia can benefit not just from individual EV drivers but also fleets (e.g. electric taxis, delivery vehicles) as electrification of commercial transport picks up. Many ride-hailing and logistics companies in the region have announced EV adoption plans, which will require dependable charging networks. Furthermore, the global EV charging station market is projected to grow from about $22.5 billion in 2024 to $257 billion by 2032 (35.5% CAGR) [ortunebusinessinsights.com]. Asia-Pacific leads this growth, reflecting how investment is flowing into charging services. Revenue opportunities range from pay-per-use charging fees, membership models, advertising, to ancillary services at charging hubs.

- Technological Leapfrogging: Since Southeast Asia is developing its charging infrastructure later than Europe/US, it can deploy the latest technologies from the start. New stations can be equipped with fast or ultra-fast chargers, smart payment systems, and even battery-backed storage to buffer the grid. This “late-mover advantage” means charging operators here can offer modern, efficient charging experiences that meet global standards, potentially leapfrogging older infrastructure elsewhere.

In summary, the outlook for EV charging businesses in Southeast Asia is bright. EV adoption is on a steep upward trajectory, fueled by supportive policies and the entry of compelling new EV models. In contrast, hydrogen vehicles pose little threat to upend the EV charging business case – they remain a distant second in the race for zero-emission mobility, especially in the consumer car segment.

“Batteries’ domination is likely to be extended”, notes the Guardian’s EV report, as massive investment in EV technology and infrastructure continues to “address questions of range and charging times”, whereas “hydrogen is a trickle” by comparison [theguardian.com]. This global direction is echoed in Southeast Asia’s plans: by focusing on electrification, the region is aligning with the winning horse in the clean transport race.

For entrepreneurs and companies eyeing the EV charging sector, now is an opportune time to get on board. Building charging networks across ASEAN will not only meet a growing market need but also help drive the EV adoption flywheel (more chargers reduce range anxiety, which boosts EV sales, creating even more demand for charging). The evidence is overwhelming that electric vehicles – from two-wheelers to cars and buses – are here to stay and will only grow in market share. Hydrogen, while interesting for certain niches, will not “beat” or replace EVs for mainstream road transport [theguardian.com].

In conclusion, the future of mobility in Southeast Asia is electric. By staying informed of the latest EV developments and understanding why alternatives like hydrogen won’t dethrone EVs, charging station operators can invest with confidence. The road ahead will see more EVs plugging in, more charging stations rising, and a cleaner transportation ecosystem taking shape – a win-win for business and the environment.

📚 Sources

IEA Global EV Outlook 2024

Source: International Energy Agency (IEA)

URL: https://www.iea.org/reports/global-ev-outlook-2024

BloombergNEF EV Outlook 2024

Source: Bloomberg New Energy Finance (BNEF)

URL: https://about.bnef.com/electric-vehicle-outlook/

Statista – Global Electric Vehicle Sales 2023–2025

Source: Statista Research Department

URL: https://www.statista.com/statistics/270603/worldwide-number-of-hybrid-and-electric-vehicles-since-2009/

The Guardian – Why Hydrogen Cars Are a Dead End

Source: The Guardian UK (2024)

URL: https://www.theguardian.com/environment/2024/mar/11/why-hydrogen-cars-are-dead-end

InsideEVs – Global and Regional EV Sales Data 2023–2024

Source: InsideEVs (2024)

URL: https://insideevs.com/news/709875/global-plugin-car-sales-2023/

Counterpoint Research – Southeast Asia EV Market Update 2024

Source: Counterpoint Research (2024)

URL: https://www.counterpointresearch.com/insights/sea-electric-vehicle-market-q1-2024/

Reuters – Southeast Asia’s EV Boom, BYD, VinFast, etc.

Source: Reuters EV Southeast Asia Reports

URL: https://www.reuters.com/business/autos-transportation/ev-expansion-southeast-asia-2024-03-28/

Nikkei Asia – EV Incentives and Battery Tech in Asia

Source: Nikkei Asia, 2024

URL: https://asia.nikkei.com/Business/Automobiles/EV-Asia

International Council on Clean Transportation (ICCT)

Source: ICCT White Papers on Zero-Emission Transport

URL: https://theicct.org

MarketsandMarkets – EV Charging Infrastructure Market Report 2024–2032

Source: MarketsandMarkets Research

URL: https://www.marketsandmarkets.com/Market-Reports/electric-vehicle-supply-equipment-market-122417520.html

Michael Liebreich – Hydrogen Ladder & EV vs FCEV Commentary

Source: Bloomberg, LinkedIn, and Liebreich Associates

URL: https://www.linkedin.com/pulse/hydrogen-ladder-v40-transport-heating-industry-michael-liebreich/

TechCrunch – CATL & BYD Battery Innovations

Source: TechCrunch (2024)

URL: